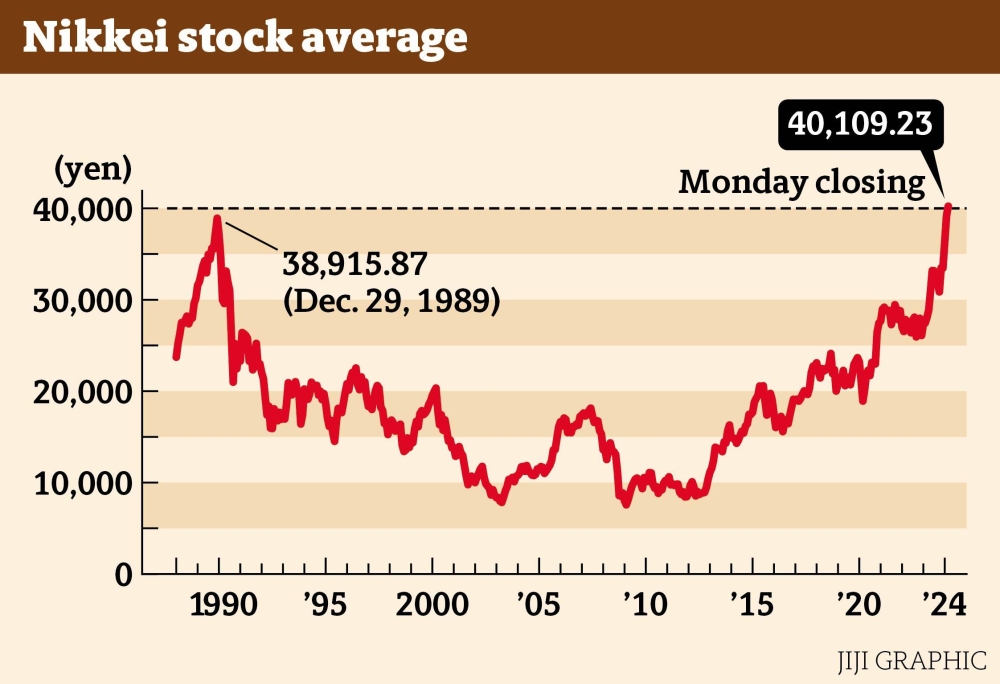

Japan’s Nikkei 225 index faced a historic collapse on August 5, 2024, plunging over 4,000 points, marking a staggering 10% drop.

This dramatic fall follows a week of global market turmoil, primarily triggered by concerns over the U.S. economy’s health.

A disappointing jobs report indicated that hiring had slowed significantly, raising fears that the Federal Reserve’s prolonged high interest rates might be stifling economic growth.

The Nikkei opened down more than 2,400 points and continued to slide, closing at approximately 32,314 points.

This downturn comes on the heels of a 5.8% drop the previous Friday, positioning it for one of the most severe two-day declines in its history.

The Bank of Japan’s recent interest rate hike added further pressure, as a stronger yen could hurt exporters and dampen tourism.

As investors reacted to these unsettling signals, the sell-off rippled across global markets, with major U.S. indexes also experiencing significant losses.

The uncertainty surrounding the economic outlook has left many wondering how long this volatility will persist and what it means for future investments.