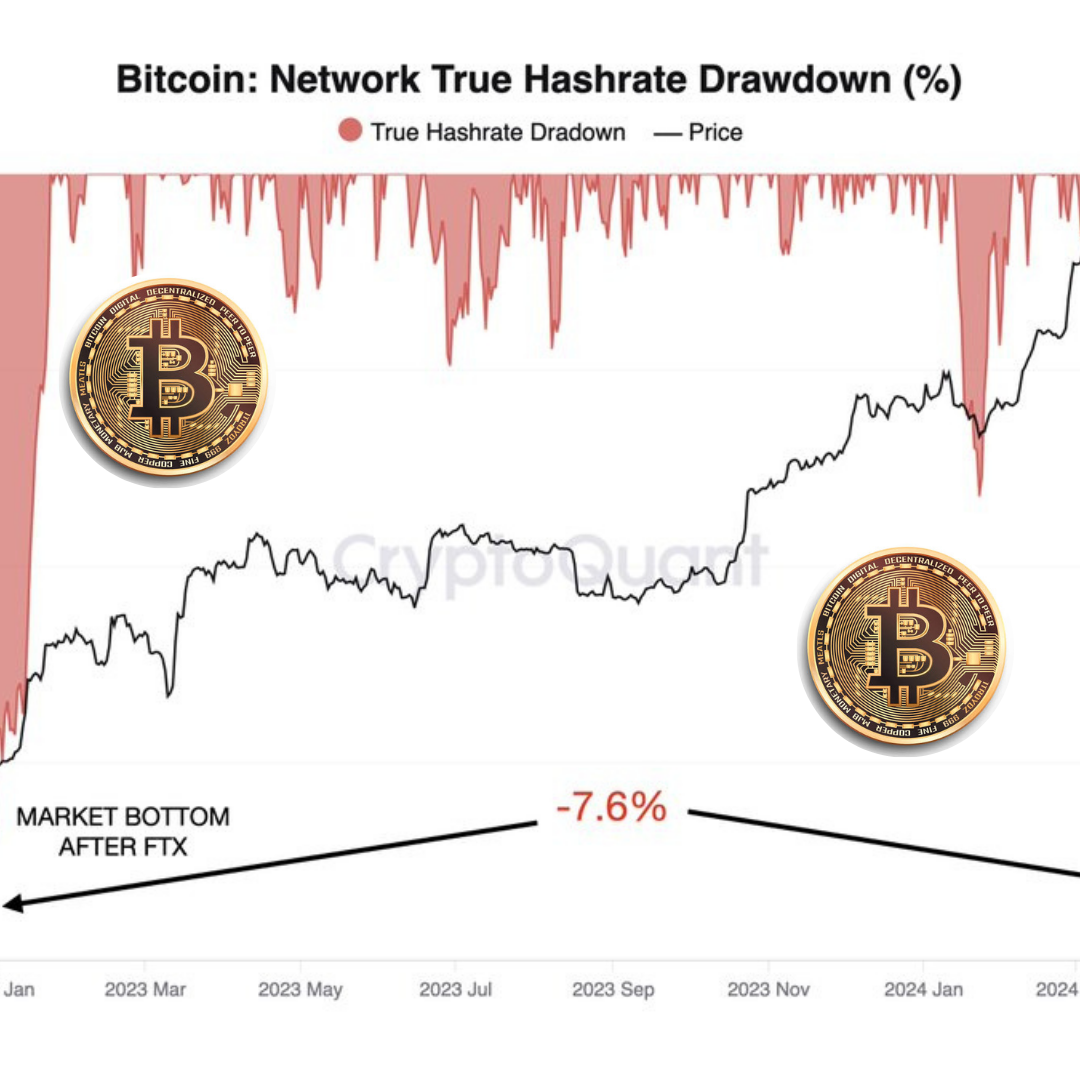

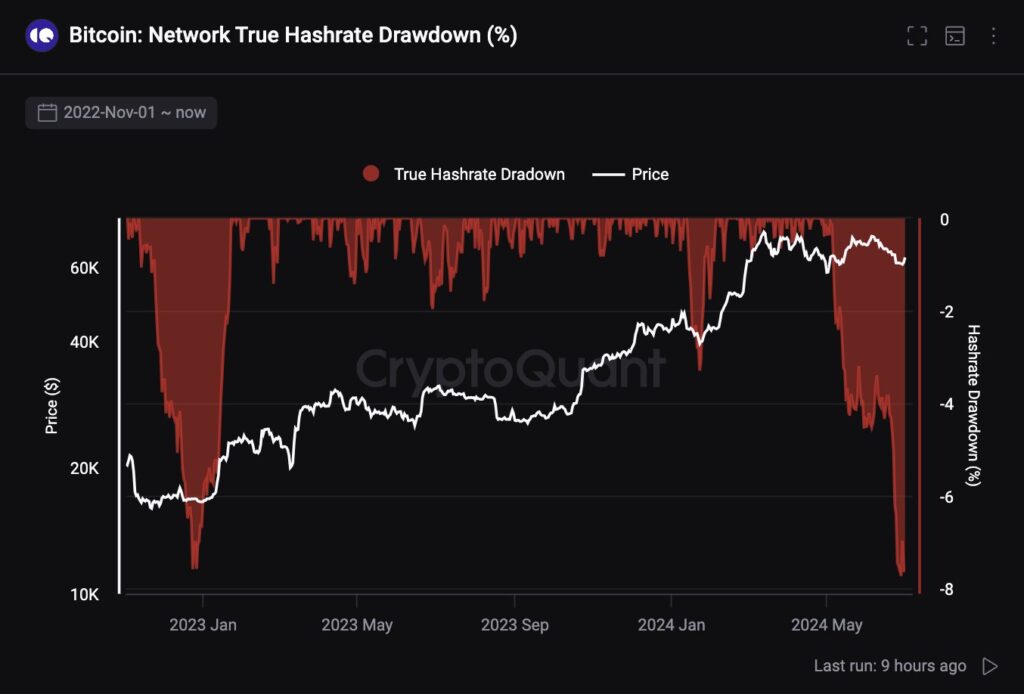

The Bitcoin hashrate drawdown has just reached levels not seen since December 2022, suggesting a potential market bottom.

The hashrate drawdown, which measures dips in the network’s computing power, has dropped to -7.6%, indicating that miners may be capitulating.

However, despite the hashrate drawdown, data shows that Bitcoin miner withdrawals have dropped by up to 90% post-halving, suggesting that selling pressure from miners has been minimised.

This implies that miners are not selling their Bitcoin holdings, even as the hashrate declines to bear market levels.

The current Bitcoin bear market has been challenging, with prices falling 74% from the all-time high.

Historically, Bitcoin bear markets have seen prices dip below the Realized Price, a metric representing the average price of the Bitcoin supply, for around 180 days.

While the 2022 bear market has been less severe in terms of drawdown, it has been punctuated by large capitulation events, with record-high one-day net realized losses