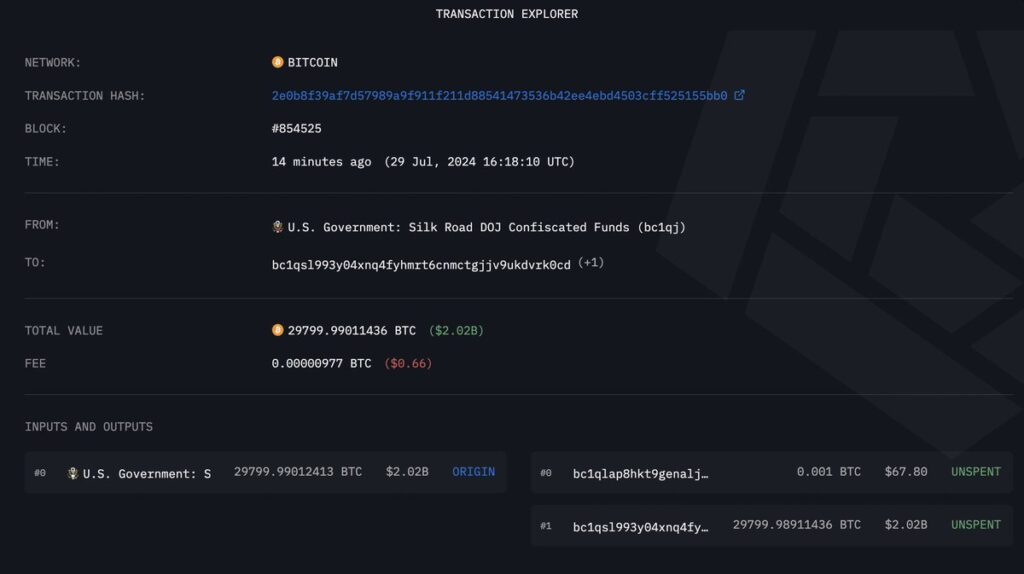

Recently, the U.S. government made headlines by transferring around $2 billion worth of Bitcoin to a new address, specifically to the cryptocurrency exchange Coinbase.

This substantial amount of Bitcoin is linked to the infamous Silk Road marketplace, which was notorious for facilitating illegal transactions.

The transfer began with a small test transaction of just 0.001 BTC, but it quickly escalated to a massive transfer of over 30,000 BTC.

This move has sparked considerable interest and speculation in the cryptocurrency community, as it suggests that the government may be preparing to liquidate these seized assets.

The Bitcoin in question was originally confiscated from James Zhong, who had illicitly acquired it from Silk Road back in 2012.

The implications of this transfer could be significant, potentially influencing Bitcoin’s market price as traders and investors react to the news.

Overall, this event highlights the ongoing interplay between government actions and the cryptocurrency market, raising questions about regulation and asset management in the digital age.