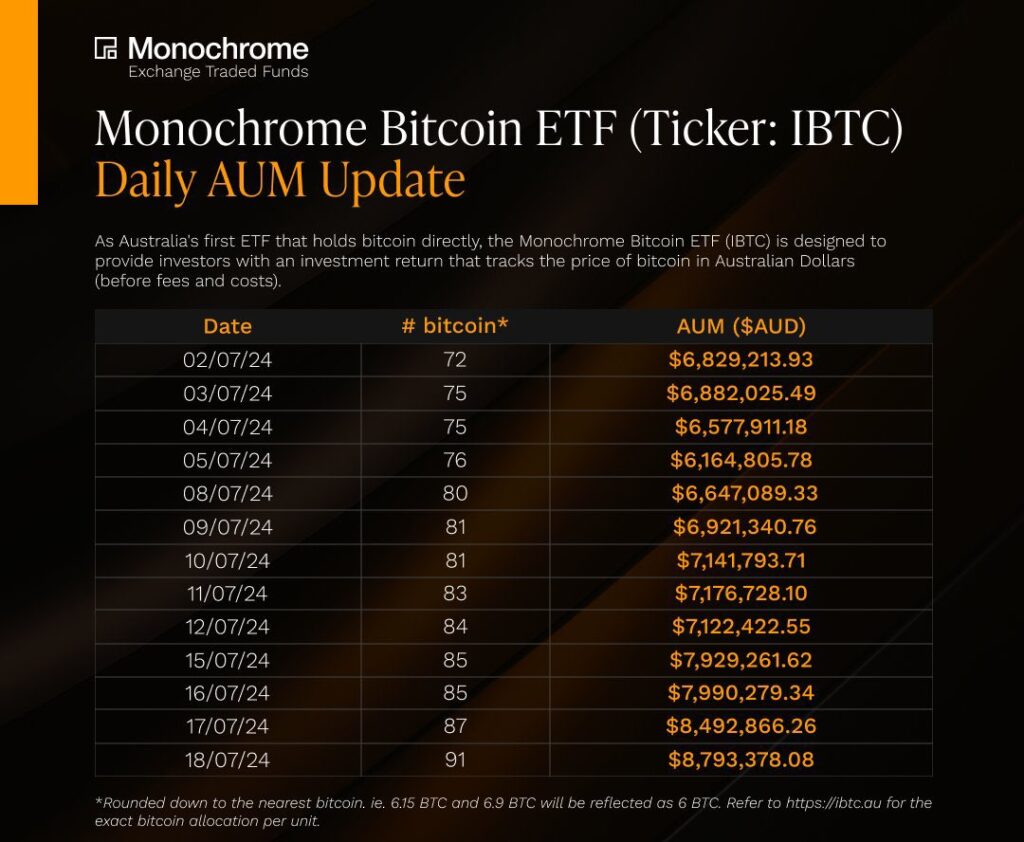

The Australian Monochrome Bitcoin ETF (IBTC) has been making headlines with its consistent daily purchases of Bitcoin.

This strategy reflects a broader trend in the financial world, where institutional investors are increasingly looking to incorporate cryptocurrencies into their portfolios.

By acquiring Bitcoin steadily, the ETF aims to reduce volatility and provide a more stable investment vehicle for those interested in digital assets.

This approach not only showcases confidence in Bitcoin’s long-term potential but also signals a growing acceptance of cryptocurrencies within mainstream finance.

The decision to buy Bitcoin daily is significant for several reasons. First, it allows the ETF to accumulate Bitcoin over time, potentially benefiting from dollar-cost averaging.

This strategy can help mitigate the impact of price fluctuations, making it a more attractive option for risk-averse investors.

Additionally, the ETF’s ongoing purchases contribute to overall market demand, which could positively influence Bitcoin’s price in the long run.

As more investors turn to regulated products like the IBTC, the cryptocurrency market may see increased legitimacy and stability.