Disclaimer: This article is only for educational purposes and don’t serve as investment advice. Trading digital assets involves significant risk and may not be suitable for all investors.

With the upcoming Bitcoin halving event scheduled to happen on 19 April 2024, many in the cryptocurrency community are eager to understand its potential impact. In this article, we’ll explore what the Bitcoin halving is, why it matters, and how it could affect the cryptocurrency market.

What is the Bitcoin Halving?

The Bitcoin halving is a pre-programmed event that occurs approximately every four years. During this event, the reward for mining new Bitcoin blocks is halved, reducing the rate at which new Bitcoins are created. This process is hardcoded into Bitcoin’s protocol and is designed to control the inflation rate of the cryptocurrency.

Why Does it Matter?

The Bitcoin halving is significant because it affects the supply and demand dynamics of Bitcoin. With the reduction in the rate of new Bitcoin issuance, the supply of Bitcoin decreases. If demand remains constant or increases, this reduction in supply can potentially lead to an increase in the price of Bitcoin. Historically, Bitcoin halving events have been associated with significant price rallies, although past performance is not indicative of future results.

The Significance Of The Historical Bitcoin halving events on the Markets

Here we will analyse the historical Bitcoin halving events, starting from the first ever halving to the last and also analyse what to expect during the imminent halving.

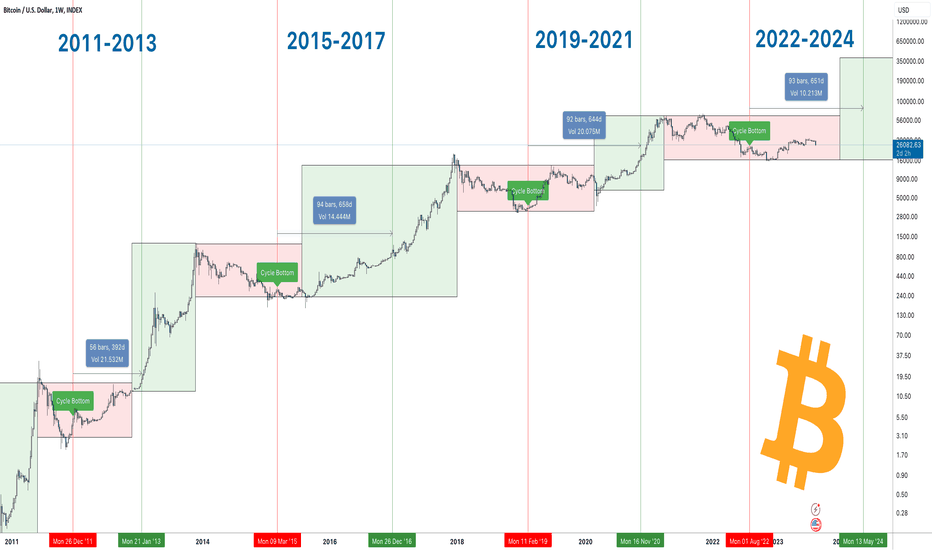

Below is a picture of the historical Bitcoin halvings to deeper understand the impact of the event:

From this picture, it is clear that bitcoin made a new All Time High (ATH) after each halving. If the same history repeats itself, then we will see bitcoin’s price soaring well above $73,000 after the halving of April 19th. Continue reading further to get a better understanding of what could happen next.

The First Bitcoin Halving (2012)

Date: The first Bitcoin halving occurred on November 28, 2012.

Block Reward Reduction: Prior to the halving, the block reward for miners was 50 BTC per block. After the halving, it was reduced to 25 BTC per block.

Impact on Price: Leading up to the halving, Bitcoin’s price experienced upward momentum as investors anticipated the reduction in new supply. Following the halving, Bitcoin’s price continued to rise steadily over the following months and years. The halving event is often cited as a contributing factor to Bitcoin’s subsequent bull run in 2013.

The Second Bitcoin Halving (2016)

Date: The second Bitcoin halving took place on July 9, 2016.

Block Reward Reduction: The block reward was reduced from 25 BTC to 12.5 BTC per block.

Impact on Price: Similar to the first halving, Bitcoin’s price saw significant appreciation in the months leading up to the event. Following the halving, Bitcoin’s price continued to climb, reaching new all-time highs in the years that followed. The halving event is considered a pivotal moment in Bitcoin’s history, solidifying its status as a deflationary digital asset.

The Third Bitcoin Halving (2020)

Date: The most recent Bitcoin halving occurred on May 11, 2020.

Block Reward Reduction: The block reward was reduced from 12.5 BTC to 6.25 BTC per block.

Impact on Price: In the lead-up to the 2020 halving, Bitcoin experienced heightened volatility and price fluctuations. Following the event, Bitcoin’s price initially saw a modest increase before entering a period of consolidation. However, in the months that followed, Bitcoin embarked on a significant bull run, reaching new all-time highs in 2021.

Overall, the historical Bitcoin halving events have had a profound impact on Bitcoin’s price and market behavior. Each halving event has been associated with increased investor interest and speculation, leading to significant price appreciation in the months and years following the event. As Bitcoin continues to mature as a digital asset, the halving events remain a key aspect of its monetary policy and scarcity narrative.

How Could it Affect the Market?

- Supply and Demand Dynamics: As the supply of new Bitcoins decreases, the scarcity of the cryptocurrency may increase, potentially driving up its price.

- Miner Economics: Bitcoin miners, who validate transactions and secure the network, may experience reduced profitability following the halving event due to lower block rewards. This could lead to a temporary decrease in mining activity or inefficient mining operations shutting down.

- Market Sentiment: The anticipation of the halving event may lead to increased speculation and trading activity in the weeks and months leading up to it. Positive sentiment surrounding the halving could contribute to upward price momentum, while negative sentiment could lead to volatility.